1

| Jan 2009 |

mood: optimistic about the future

currently working on: All the King's Women outline; I have it almost figured out…!

currently reading: Iron Kissed by Patricia Briggs

2008 was long and difficult yet surprisingly interesting and rewarding as well.

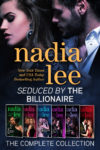

On the writing front, the year started off with selling a book to Samhain so that's always fantastic. But the biggest accomplishment is of course signing with an agent. I also left a critique group, but I think in a way it was inevitable. I do miss many of the writers I met there. Oh, and I have a new pretty website. :)

On to the financial matters — my mom lost a ton of money thank to subprime. I wish she'd listened to me when I asked her to sit tight for another year before investing in the funds she was interested in. When you hear about banks raking in record profit from issuing more and more subprime loans, which are by nature very risky, you know there's something fishy going on, and that it's going to fall when weaker real estate markets start to lose their value one by one. I started the year with a ton of debt, but my venture investment paid off right before Christmas, so I'm starting the year with no debt (except the mortgage I have on my house) and some extra cash.

Talk about strange since I never expected to get any payment from the investment, given what's going on in the market.

My writing goals for 2009 are:

- Complete two manuscripts. I think I figured out what's wrong with All the King's Women and Nine. W00t!

- Read 52 books. Fiction, non-fiction, it doesn't matter. I just need to read to get more ideas and to recharge. I noticed that I didn't read all that much during the latter half of 2008, and it really affected my creativity.

- Take time off! I'm absolutely terrible at taking time off and relaxing. I always feel like I have to work or else. Of course this is unsustainable, and I do burn out and can't write for a month or two. Very unproductive. So I'm forcing myself to take two days a week off, along with major holidays, etc. Oh, I'm also making myself go to the gym three times a week at least.

- Read 2 how-to books (this does not count toward my goal #2) or take two online classes. I already signed up for a January class on how to not sabotage myself. I'm also eying another class on line edits because I think I can benefit from it.

- Write 2 blog posts a month. I'm terrible at blogging because I just forget at times. So I resolve to do better this year. :)

- Stop looking for and/or seek crit partners / groups. It's really not that I think I'm too good for feedback, but it takes a lot of time and energy to find a good crit group, and I've decided (after a long and careful consideration) that ROI would be better if I stick with the beta readers I have right now and spend the time I would've used to find good crit groups / partners on reading and taking classes. (BTW — this doesn't mean I don't want any CPs or anything if one happens to come my way, but I just won't be actively looking for them either.)

- Evaluate and identify all not-helpful-anymore loops, groups, etc. Resign from them by Jan 31. This is a must since I decided that I don't have time for them. I stayed with most of them because you “have to network” but I had to wonder networking isn't about being in a group that sucks up all your time but gives very little in return. I should know better (or else my management consulting professor would send me a stern note saying she taught me better than this).

How about everyone else? How was your 2008 and what are your goals for 2009?